Chime Savings

Renowned for its commitment to eliminating unnecessary fees, Chime provides its account holders with a seamless digital banking experience, furnishing them with debit or credit cards and enabling access to a robust online banking system via its user-friendly website and mobile applications.

By introducing a bespoke savings feature, Chime is set to empower users to meticulously set, monitor, and accomplish their savings objectives. This functionality not only aids in instilling prudent financial habits but also plays a pivotal role in enhancing the users' overall financial health and stability.

2023

Skills:

User Experience, UI Design, User Research, Competitive Analysis, User Testing, Branding

Partner:

DesignLab

The Challenge

Chime offers a range of financial services, including Credit Builder, SpotMe, and a savings account. However, it lacks a “savings goal” feature that allows users to direct their money towards specific goals like a trip or item. Some banks offer this feature, but it often comes with the requirement of opening an additional account and paying extra fees. In the past, customers have relied on alternatives like the “white envelope” method or saving cash, but these options are not as secure as online banking and do not earn interest.

Project goals:

Creating a “targeted savings” feature for Chime, where the user can set goals and reminders to save, either automatically or manually as needed.

Understanding users’ financial habits when it comes to savings and what could motivate them to develop healthy financial habits.

Discovering current pain points and opportunities for this in the fintech space and compare what big banks are doing with savings accounts beyond “keeping the money safe.”

Research

Core User

Mary B. - The Business Traveler

Mary is a 28-year-old marketing professional who has just started earning a steady income. She is tech-savvy and likes to have control over her finances. She is currently renting and would like to budget better.

Goals

Saving money for the future.

Have an emergency fund.

Save enough for a down payment on a house.

Challenges

Mary struggles with staying motivated to save money consistently.

She feels overwhelmed by the number of options and strategies for saving money.

She needs help setting up a system she can easily follow without additional accounts.

Needs

A simple savings feature that helps her set and track her savings goals.

Reminders to help her stay on track.

Guidance for how to make the most out of her savings account.

Methodologies and Insights

Secondary Research

Secondary Research was executed in order to understand the current landscape around savings and finances of Americans. These are some key facts to understand how financial literacy impacts young Americans:

“64% of Americans live paycheck to paycheck.”

“41% of millennials have no retirement savings.”

“40% of Americans would struggle to cover a $400 emergency.”

Competitive Analysis

Understanding what others are doing in the online-centric savings space is key to create an offering that will be meaningful to users. Three key competitors were selected to analyze:

SoFi Savings

Strengths

High yield savings option

No fees

Mobile app

Weaknesses

Very limited customer service

No branch locations

No budgeting tools

PNC Virtual Wallet

Strengths

Budgeting tools to set financial goals

Round up savings

External account support

Weaknesses

No high yield savings option

Monthly fees for some plans

Limited amount of branches

AMEX High Yield Savings

Strengths

High yield savings

No monthly fees

Easy external bank accounts transfers

Weaknesses

No budgeting tools

Limited customer service

Doesn’t offer mobile app

Secondary research found that the majority of the current products provide high-yield savings and the ability to integrate external accounts, but only one of them has budgeting tools. This gives Chime the perfect opportunity to integrate targeted savings as part of its main offerings. This will teach users financial habits and give them the right tools to grow their money.

Survey Insights and User Interviews

To gain deeper insights into the tools currently utilized by potential users for managing their finances, as well as to identify strategies that could assist them in improving their financial positioning and achieving greater success, a survey was conducted. These are the key findings from them:

81.3% of users have specific savings goals

68.8% of users save money every paycheck

50% of users do not have a way of tracking their savings

93.8% use an online banking product

Interviews Conducted

User 1: Uses employer-backed 401k product but wants app-based features for accessibility and user-friendliness. Thinks technology should play a huge role in helping people save.

User 2: Wants a savings product that shows progress, allows him to set goals with reminders, and offers guidance and assistance with savings.

User 3: Experiences issues with his bank’s savings account and would like to see goal-related features in savings products. Believes technology should be an option for helping people save, but not the only option.

Overall, all interviewed users thought that technology should play a role in the way money is saved and help create better financial habits. They all generally agreed that having a way to track savings goals would be a good motivator to put money away for the future.

Wireframing and User Testing

Features and User Flows

The insights from the survey and interviews allowed for the key functions of the project to be identified to create a viable product and were used to create the flows that allowed testing:

Complete Initial Setup

Create a Savings Goal

Modify an Existing Goal

Key Functions

Goal-Oriented Savings

Automatic Transfers

“Savings Buckets”

Single account management

Reminders

“Nice to Have” Functions

Full Account Budgeting

Third-Party Service Integration

Financial education modules

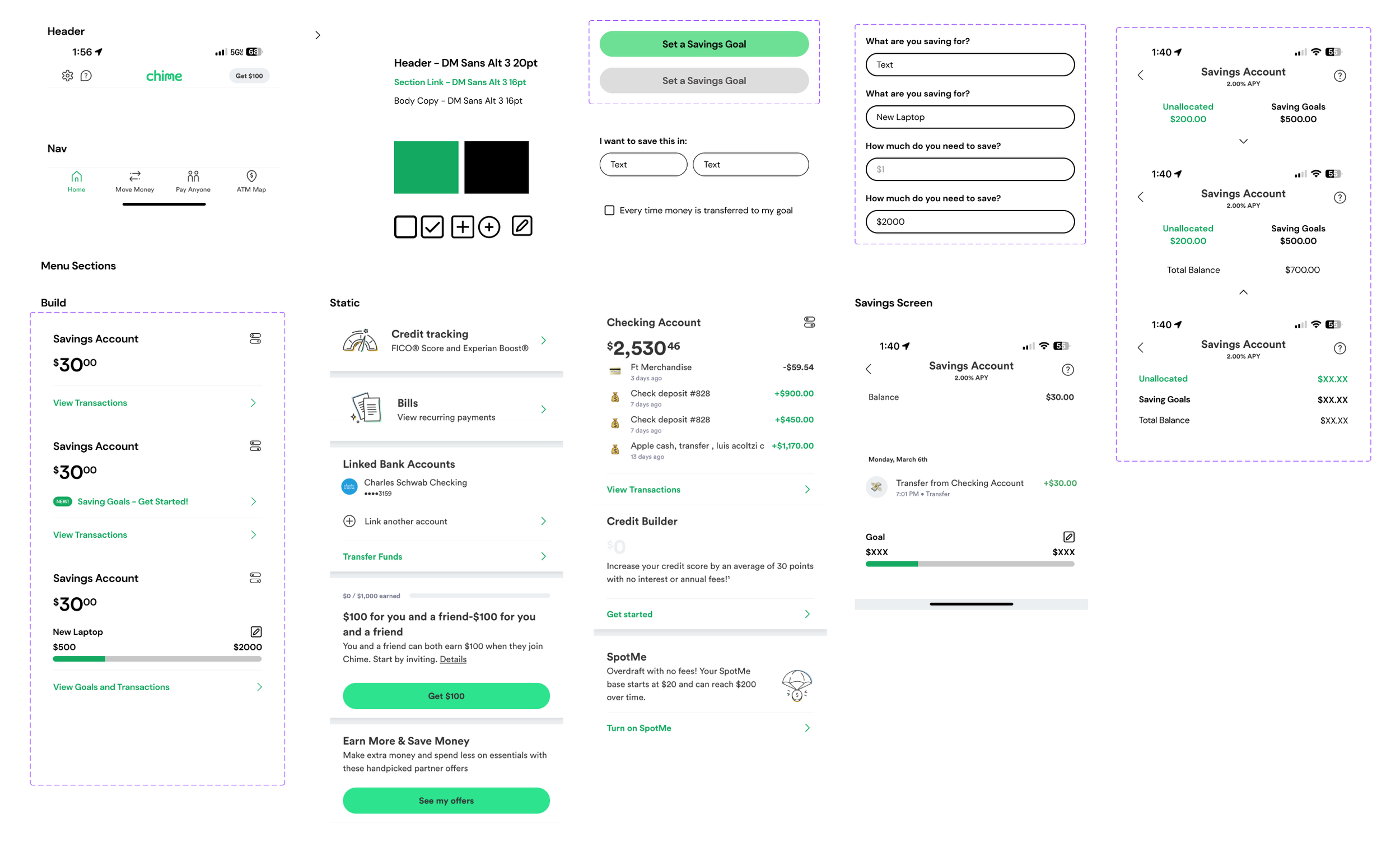

Visual Design

Low fidelity sketches

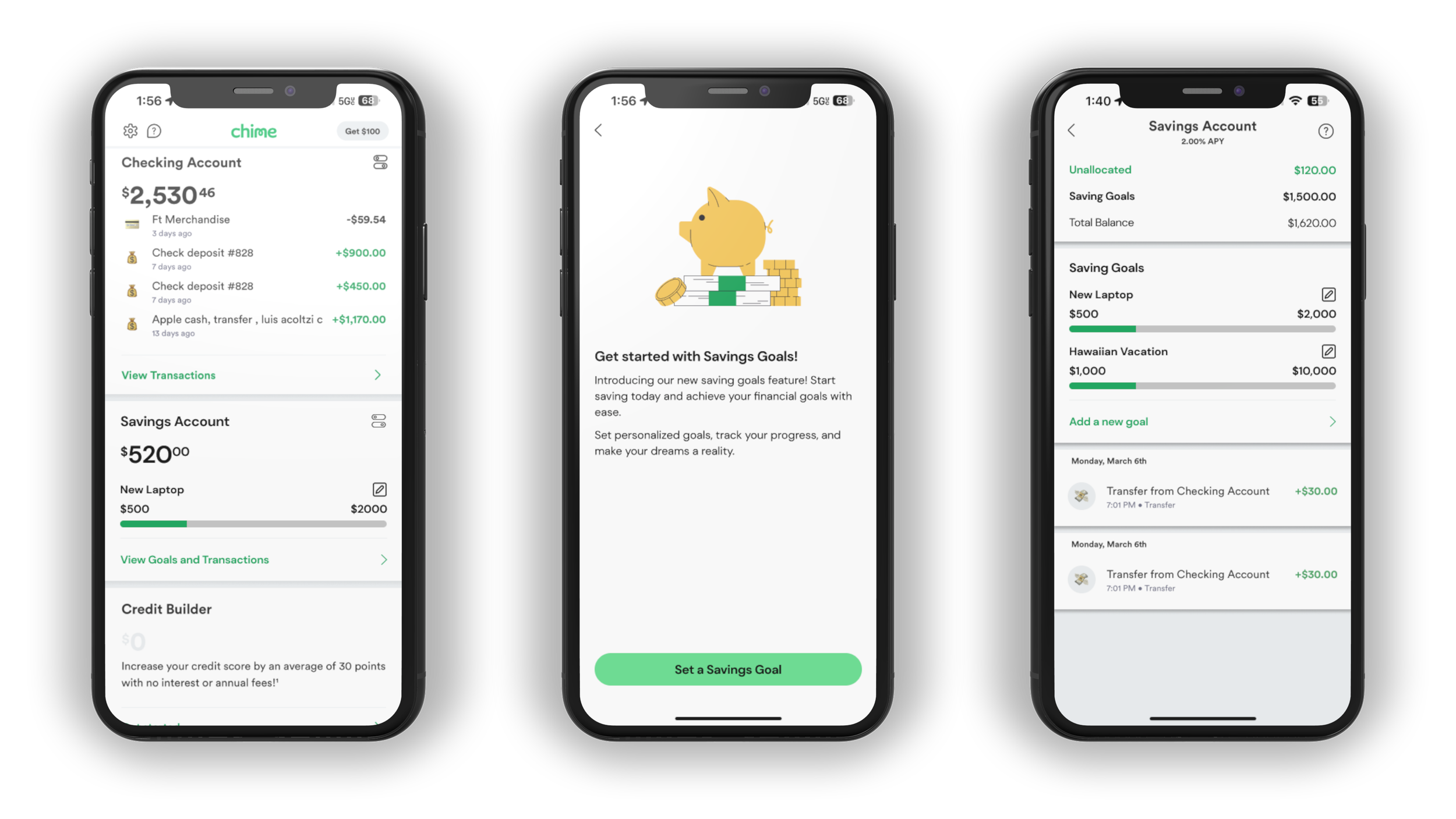

High Fidelity Wireframe

UI Elements

Prototype and Solution

The prototype was tested with three users who provided feedback on the design, layout, and content of the flows.

All users that were interviewed found the flows streamlined and easy to navigate. The outcomes were as expected for all users with one user suggesting that knowing how much is saved every week might be useful, while another suggested giving users an estimate of how much to save every week to motivate them. Overall, the experience was clean, simple, and easy to understand.

Complete Initial Setup

Create a Savings Goal

Modify an Existing Goal

Reflection

Adding an automated savings feature to Chime has proven useful for users who tested it. The secondary research, competitor analysis, user surveys, and interviews revealed that many Americans struggle with saving money and desire a simple and accessible savings tool. By creating a targeted savings feature that allows users to set and track their savings goals, Chime can help users develop healthy financial habits and improve their overall financial well-being.

Understanding the perspectives of different users during both the research and testing phases of the project was key to creating a better product that would align with the feature’s goals and users’ expectations.